[ad_1]

The Ethereum Digital Machine (EVM) is the core of the Ethereum community and the center of sensible contract deployment and execution. EVM to Ethereum is sort of a CPU to a pc.

At the moment, 80% of the highest 10 chains are appropriate with the EVM, and even Non-EVM chains like Terra and Solana are making EVM-compatible options or can already function with Ethereum’s account system (NEAR’s Aurora, Solana’s Neon, Polkadot’s Moonbeam, and many others.)

Why Is EVM compatibility so Essential?

For builders, an EVM-compatible chain creates a code execution surroundings much like the EVM. It signifies that Ethereum builders can simply and shortly deploy protocols to the chain with out having to put in writing code from scratch.

For customers, the benefits of an EVM-compatible chain embrace decrease gasoline charges, sooner settlement, and the identical handle format as Ethereum, making for a extra user-friendly surroundings.

Aside from that, EVM compatibility can drive site visitors acquisition and ecosystem growth as a result of Ethereum customers can shortly migrate to new chains.

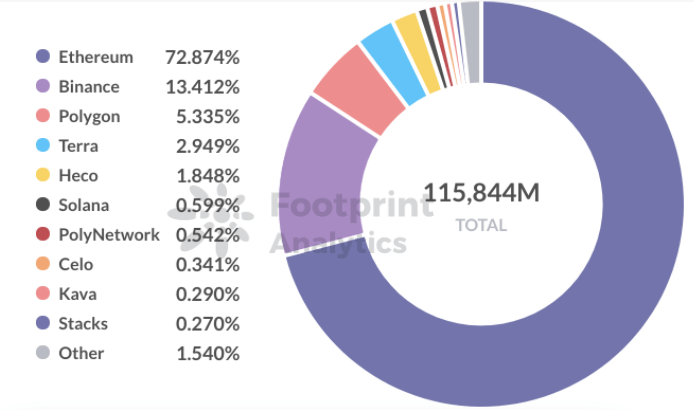

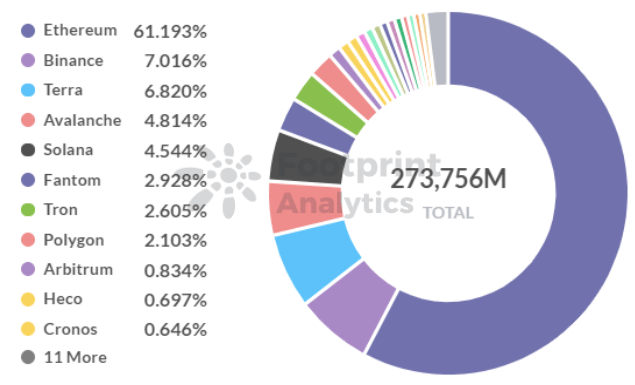

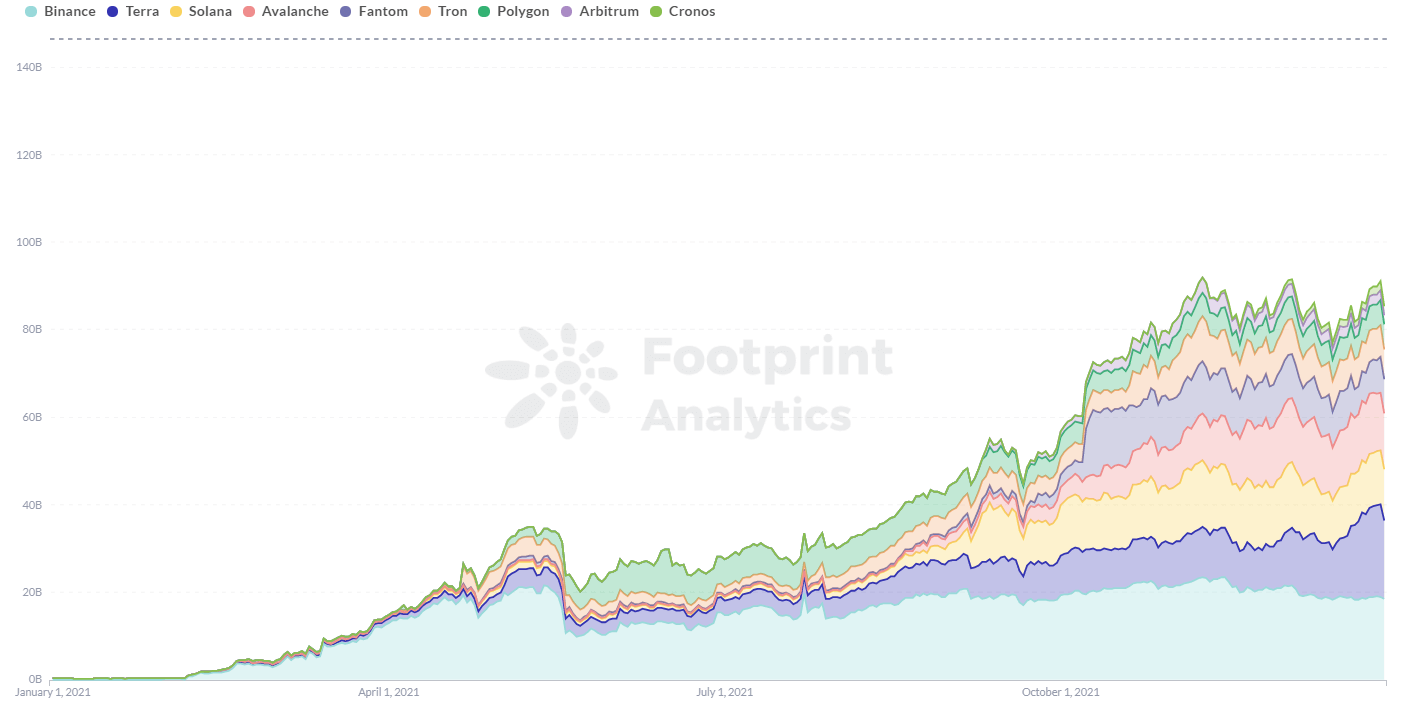

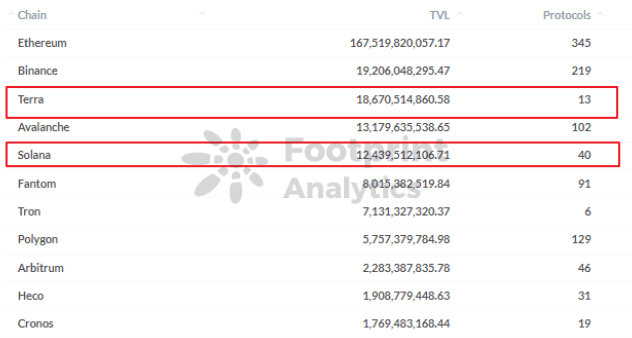

Footprint Analytics’ information reveals that, though Ethereum remains to be the chief amongst public chains, its market share dropped from 72.87% to 61.19% previously six months—greater than 10% in absolute phrases. Rising chains are rising quickly and changing Ethereum.

Ethereum is essentially the most energetic chain for DeFi initiatives and customers, and can be a gathering place for cutting-edge initiatives, e.g. NFT ecosystems. The quickest approach for brand spanking new chains to develop is to draw Ethereum site visitors, and EVM compatibility is essentially the most handy answer. On this approach, builders can shortly “copy and paste” contracts from Ethereum to different chains.

What Is the Distinction Between EVM and Non-EVM Chains?

Prime 10 public chains and their classes:

From the chain TVL information, whereas the variety of non-EVM appropriate public chains is small, Solana and Terra account for over 11% of the general TVL in 2021.

Let’s evaluate two standard EVM-compatible chains, Avalanche and Arbitrum, with two non-EVM appropriate chains, Terra and Solana.

Appropriate Ecosystems Are Extra Affluent

Trying on the on-chain venture information from Footprint Analytics, there are considerably extra initiatives deployed on EVM-compatible public chains.

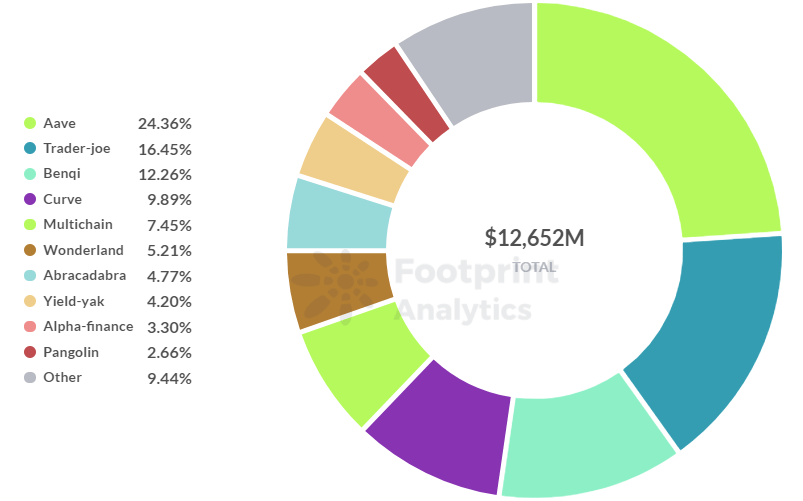

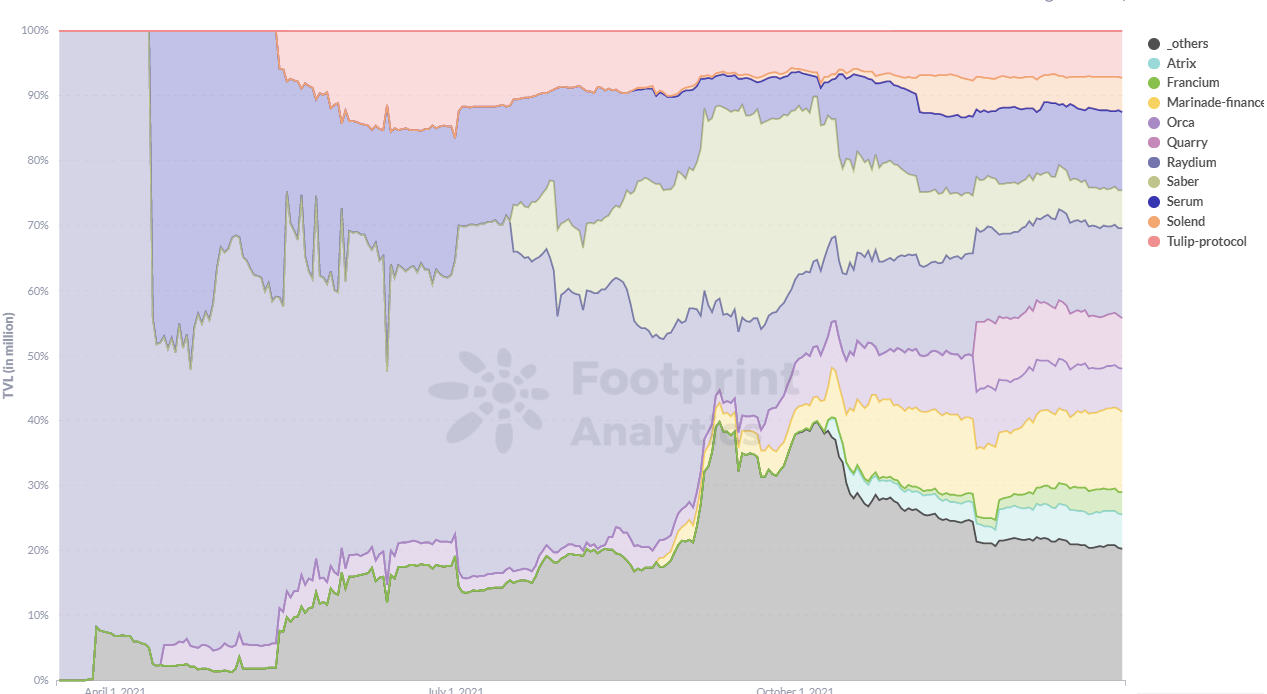

There are a minimum of 40 initiatives on Avalanche and Arbitrum, whereas there are comparatively few initiatives deployed on Solana and Terra.

As talked about above, builders need EVM compatibility to duplicate and deploy to new chains shortly, and the drawback of non-EVM appropriate chains is apparent by way of the variety of initiatives.

Among the many EVM-compatible chains, AAVE is the venture with the best TVL on Avalanche and Curve has the best TVL on the Arbitrum chain, each of which have been migrated from Ethereum.

Non-EVM Chains Give Tasks Extra Room for Innovation

Breaking away from the restrictions of Ethereum, heterogeneous chains have extra room for innovation.

For instance, initiatives like Raydium and Serum within the Solana chain are distinctive to Solana. However, Terra is a particular public chain that focuses on connecting on-chain and off-chain funds.

General, the benefits and drawbacks of EVM and non-EVM are clear.

EVM Appropriate

- Execs: Scalable and simple emigrate from the Ether ecosystem; initiatives have simpler entry to customers.

- Cons: Much less progressive as a consequence of Ethereum and EVM guidelines.

Non-EVM Appropriate

- Execs: Extra differentiated and progressive purposes could be generated; excessive person migration prices and extra alternatives to construct ecosystem limitations.

- Cons: Excessive value for builders with entry limitations, troublesome emigrate initiatives and customers from different chains.

EVM or Non-EVM?

EVM compatibility is the first situation for evaluating a public chain platform.

EVM-compatible public chains can shortly achieve prospects and develop within the early levels with the benefits of Ethereum. Nonetheless, they should compete with many different chains within the Ethereum ecosystem. Due to this fact, they’ll have benefits by way of person expertise, developer friendliness and ecosystem incentives.

Non-EVM appropriate chains usually tend to develop in trending classes and niches the place new concepts are rising. NFTs, GameFi, and funds are all areas the place heterogeneous public chains can thrive. With their utility eventualities, innovation may also be profitable within the DeFi market.

It’s inconceivable to conclude that EVM or non-EVM chains are higher as a complete. Somewhat, every case is totally different and builders should select a public chain that matches their venture’s growth path.

For DeFi customers, it’s extra essential to guage the potential of the venture from a unique perspective based mostly on the mannequin.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain information and uncover insights. It cleans and integrates on-chain information so customers of any expertise degree can shortly begin researching tokens, initiatives and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own personalized charts in minutes. Uncover blockchain information and make investments smarter with Footprint.

CryptoSlate E-newsletter

That includes a abstract of an important every day tales on this planet of crypto, DeFi, NFTs and extra.

Get an edge on the cryptoasset market

Entry extra crypto insights and context in each article as a paid member of CryptoSlate Edge.

On-chain evaluation

Value snapshots

Extra context

Be a part of now for $19/month Discover all advantages

[ad_2]

Source link