[ad_1]

Key Takeaways

- The crypto market is approaching its worst January shut since 2015 after dropping 22.7% this month.

- The market is over $1 trillion from its peak.

- Although Bitcoin, Ethereum, and different property are struggling, the NFT market continues to be booming.

Share this text

The crypto market has shed $500 million of its worth this month.

Crypto Market Heads for January Shut

It appears just like the crypto bull market may very well be over—at the very least for fungible property.

It’s been a tough few weeks for Bitcoin, Ethereum, and different digital property after the market has shed over $1 trillion in worth since its November peak. Now, the market is approaching its worst January shut since 2015.

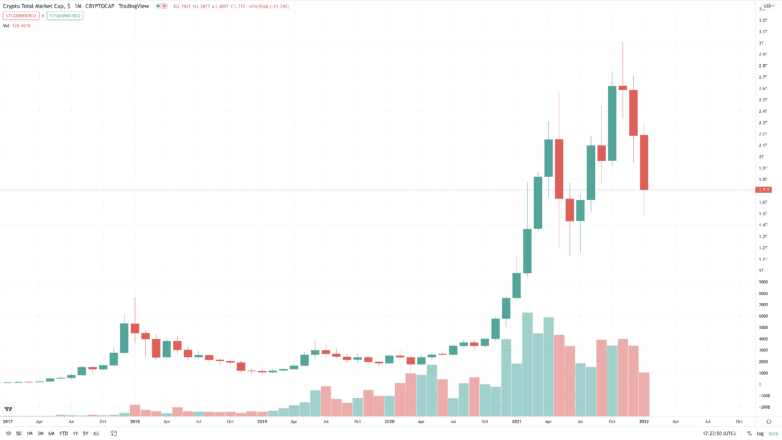

In keeping with information from TradingView, the worldwide cryptocurrency market cap has misplaced $500 million this month, tumbling from round $2.2 trillion to $1.7 trillion at present. Although extreme, the 22.7% drop shouldn’t be the one weak month-to-month efficiency crypto fans have endured over the previous couple of months. In December, the market tanked 15.5%. The market additionally suffered a brutal crash final Could amid fears of China’s Bitcoin mining ban and an overexhausted setting, closing the month 24.1% within the purple.

Whereas the Could crash was essentially the most extreme the market has seen for a while, this month’s efficiency appears set to go down as crypto’s worst January on document. The 2 years previous to this, the market has kicked off the 12 months with a inexperienced month. In January 2019, the market shed round 9.4% of its worth. January 2018 closed 15.3% within the purple, kicking off an prolonged bear pattern that noticed the market tank 80% within the area of a 12 months. By the tip of 2018, Ethereum had bled 94% from a excessive of $1,430 to $80. Many different property fell over 95% and by no means recovered to new highs.

At press time, Bitcoin is 44.5% off its $69,000 all-time excessive. Ethereum is 45.7% off its peak, and lots of the winners of 2021—together with Solana and Axie Infinity—are over 60% wanting their highs. The dog-themed meme cash Dogecoin and Shiba Inu are respectively down about 80% and 75%.

Whereas main property have been exhausting hit of late thanks partly to Omicron fears and the Federal Reserve’s menace of rate of interest hikes, some corners of crypto are booming. NFTs have fared significantly properly in latest weeks, possible as a result of most merchants value their digital collectibles in Ethereum. In keeping with information from Dune Analytics, OpenSea has seen a document $4.8 billion in quantity this month as demand for decent collections like Bored Ape Yacht Membership and Cool Cats soars.

Disclosure: On the time of writing, the writer of this function owned ETH and a number of other different cryptocurrencies.

Share this text

Bitcoin, Ethereum Goal to Rebound From Brutal Downturn

Bitcoin and Ethereum seem to have reached a crucial help degree following a serious market correction. Though the downtrend is probably not over, there are causes to consider {that a}…

What’s Rarible: A DAO for NFTs

What was as soon as dismissed as a foolish and costly sector, NFTs give creators entry to international markets in a approach that’s by no means been potential earlier than, and it’s all because of blockchain.These acquainted…

Bored Ape Yacht Membership Hype Continues With $2.8M Sale

A Bored Ape Yacht Membership NFT bought for $2.8 million final night time as demand for the gathering reaches new highs. The present flooring value for a Bored Ape is 116.9…

Bitcoin to $1M, Ethereum to $180,000 by 2030: ARK Report

In a brand new analysis report, American funding agency ARK Make investments has shared daring value predictions for Bitcoin and Ethereum for the tip of this decade. ARK Makes Bull Case for…

[ad_2]

Source link