[ad_1]

newbie

If in case you have ever been desirous about any type of buying and selling or monetary markets, you will have in all probability heard the phrases “bid” and “ask.” However what do they imply, and the way can studying extra about them assist you improve your earnings?

The Bid Worth

The title “bid” worth refers to the truth that you’re mainly bidding an X sum of money to purchase an asset. In case your bid is the very best, you can be the one who will get that asset. Most costs you will notice on exchanges and worth aggregators are equal to the very best shopping for worth out there for that asset.

The bid worth is the very best worth {that a} market participant is prepared to pay for any given asset.

Understanding the Bid Worth

When you promote an asset on the present market worth — the worth displayed when viewing the asset on an change — then which means you might be promoting it at its bid worth. That’s the utmost worth an asset will be bought for in the mean time.

The Ask Worth

The title “ask” worth refers to the truth that you’re mainly asking to purchase an asset at X worth. In case your asking worth/promote worth/supply worth is the bottom worth out there available on the market, you’re going to get the deal.

The ask worth is the bottom worth for which a market participant is prepared to promote any given asset.

Understanding the Ask Worth

When you purchase an asset on the worth you see on the change — place a market order — it means you’re shopping for it at its promoting (ask) worth. It’s the minimal worth belongings will be purchased for.

What Is the Distinction Between a Bid Worth and an Ask Worth?

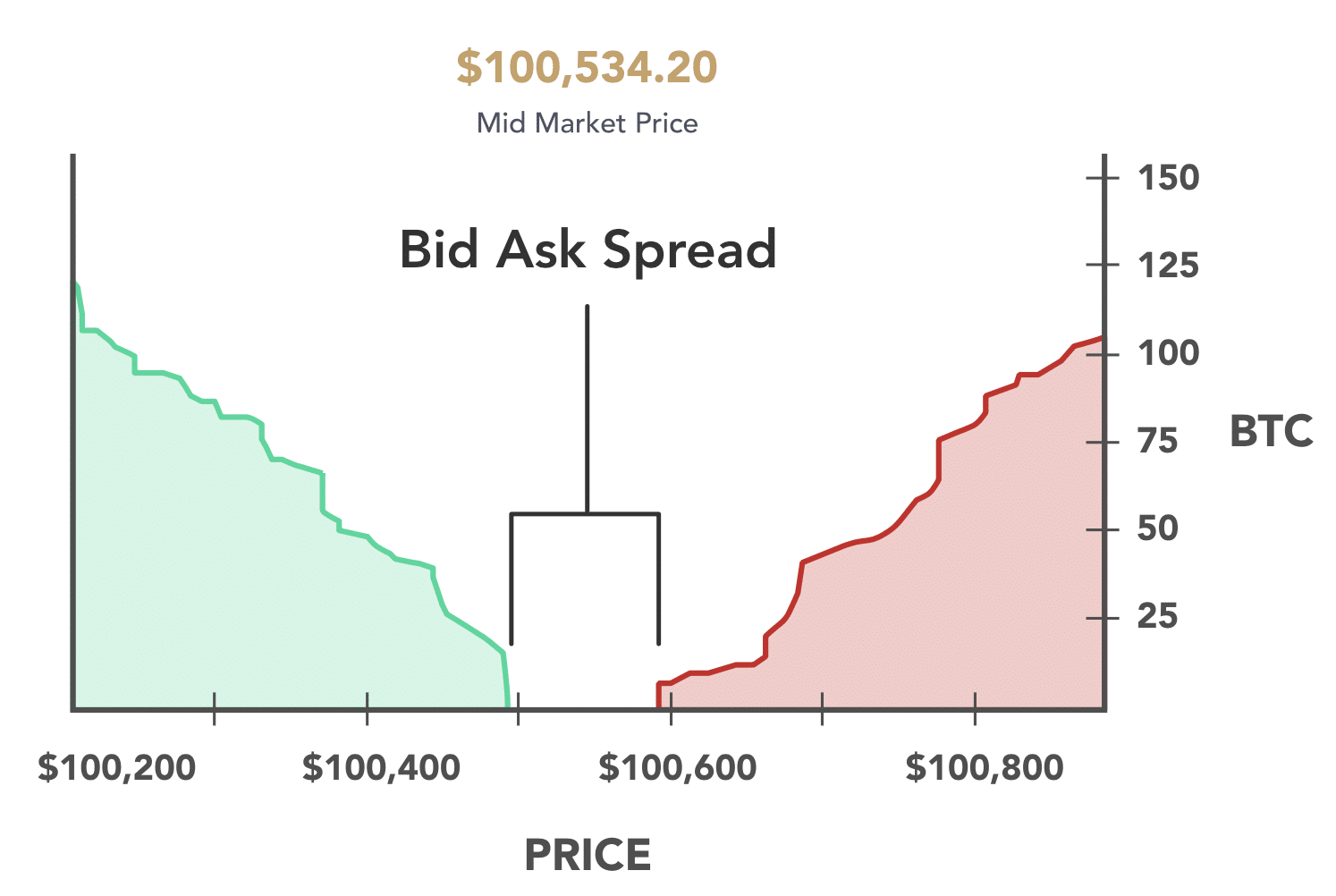

By definition, the ask worth will all the time be greater than the bid one. The numerical distinction between the bid and ask is known as the bid-ask worth unfold.

The Bid-Ask Unfold Definition

The bid-ask unfold is solely the distinction between the very best worth being supplied for an asset (bid) and the bottom worth it’s being bought for.

The bid-ask unfold itself doesn’t essentially replicate the worth actions of an asset — as an alternative, it reveals the general degree of buying and selling exercise and quantity available on the market. The extra trades are being made, the smaller the distinction between the bid and ask worth is.

Who Advantages from the Bid-Ask Unfold?

All market makers can revenue from the bid-ask unfold. These are market individuals that make a two-way worth quote, offering each a bid and a proposal. Every market maker gives liquidity and depth to the market.

Right here’s an instance of how a market maker can revenue from the bid-ask spreads: let’s say dealer Alex quotes a purchase order at $10 whereas concurrently opening a promote order for $11. Regardless of which considered one of these closes first, the market maker’s revenue will nonetheless be equal to $11 − $10 = $1.

Being a market maker isn’t simple, and it’s undoubtedly not really useful to everybody — it usually entails proudly owning a major quantity of an asset you might be planning to commerce.

What Does It Imply when the Bid and the Ask Are Shut Collectively?

The smaller the unfold, the higher the liquidity of the asset. It additionally signifies that the demand for that asset is at present excessive. A small bid-ask unfold is known as “slim.” Slim bid-ask spreads make it simpler for brand new individuals to enter the market.

The larger the unfold is, the extra revenue will be made. Nevertheless, the upper reward additionally comes with the next threat and better prices — when the bid and ask costs are additional aside, buying and selling can turn out to be a slightly laborious and time-consuming exercise.

Instance of Bid and Ask

Let’s think about that there’s a lady named Emma who actually desires to purchase some Bitcoin on an change. She will see that BTC is buying and selling within the vary between $35K and $37K, however Emma doesn’t need to pay greater than $35,500 for 1 BTC, so she locations a restrict order at that worth. $35.5K is her present bid worth.

However, there’s Simon — he has not too long ago discovered his outdated crypto pockets and needs to promote 1 BTC that was in it. He sees the identical vary of costs Emma does and decides that he desires to promote his Bitcoin for at least $37.5K. That’s his ask worth.

If we think about that these two quantities are the bottom/highest costs anybody is prepared to promote/purchase Bitcoin respectively at on that specific change, then the bid-ask unfold can be $37,500 − $35,500 = $2,000.

Disclaimer: Please notice that the contents of this text are usually not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.

[ad_2]

Source link