[ad_1]

That is the primary publication of the Market’s Compass US Index and Sector ETF Examine to be revealed in our Substack Weblog that may spotlight the technical modifications of the 30 US ETFs that we observe on a weekly foundation. Previous publications could be accessed by way of The Market’s Compass web site or by contacting us immediately.

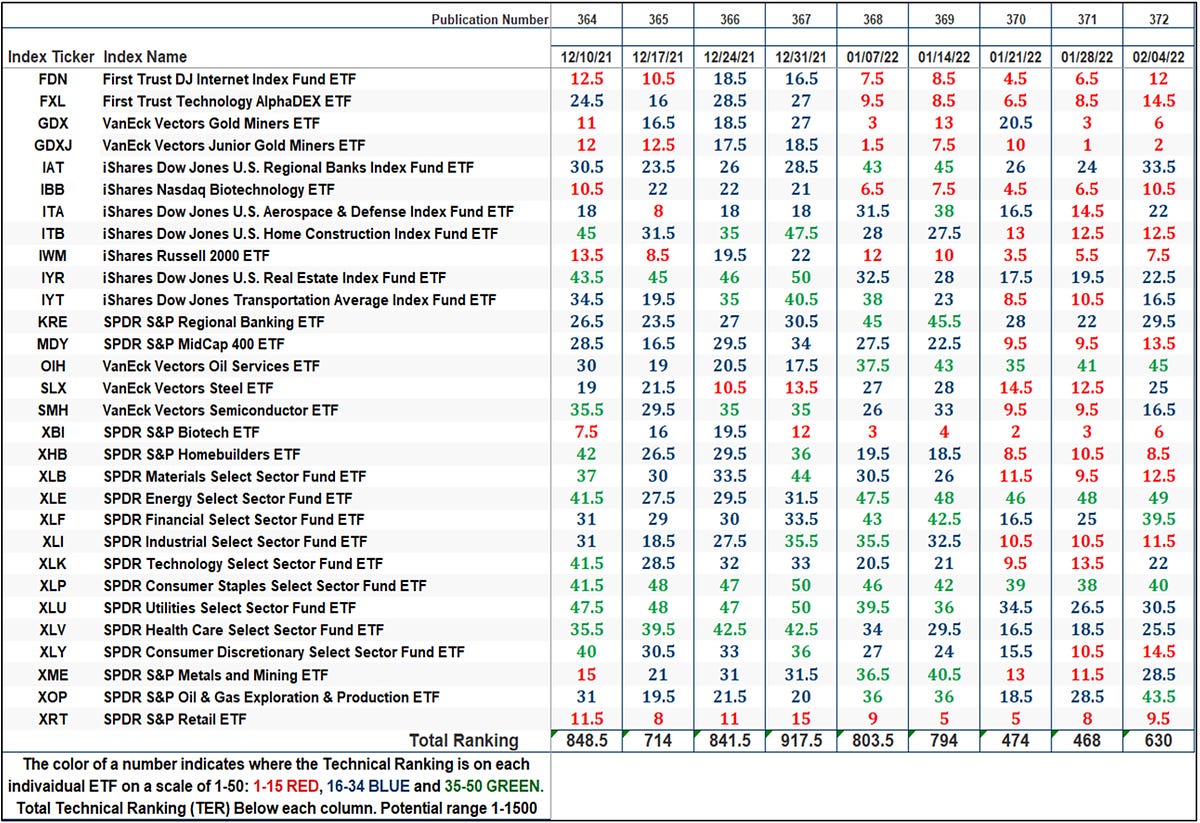

This Week’s and eight Week Trailing Technical Rankings of Particular person ETFs

The Excel spreadsheet beneath signifies the weekly change within the Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a completely quantitative strategy that makes use of a number of technical issues that embrace however should not restricted to pattern, momentum, measurements of accumulation/distribution and relative power. If a person ETFs technical situation improves the Technical “TR” rises and conversely if the technical situation continues to deteriorate the “TR” falls. The “TR” of every particular person ETF ranges from 0 to 50. The first take away from this unfold sheet must be the pattern of the person “TRs” both the continued enchancment or deterioration, in addition to a change in route. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity could be seen as an overbought situation however with due warning, over bought circumstances can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply turn into extra overbought. A sustained pattern change must unfold within the “TR” for it to be actionable. The colour of a quantity signifies the place the “TR” is the place every particular person ETF is on a scale of 0-50 with 0-15 in Pink, 16-34 in Blue and 35-50 in Inexperienced and could be seen as a warmth map.

As could be seen above, for the reason that center of December, the XLP (SPDR Shopper Staples Choose Sector Fund ETF) has sported a “TR” that has constantly been within the higher quartile of the 0-50 vary. Additionally noteworthy, has been the continued optimistic technical situation of vitality ETFs over the previous 5 weeks. For the reason that begin of the yr, the XLE (SPDR Vitality Choose Sector Fund ETF) in addition to the OIH (VanEck Vectors Oil Companies ETF) have proven enchancment of their “TRs”.

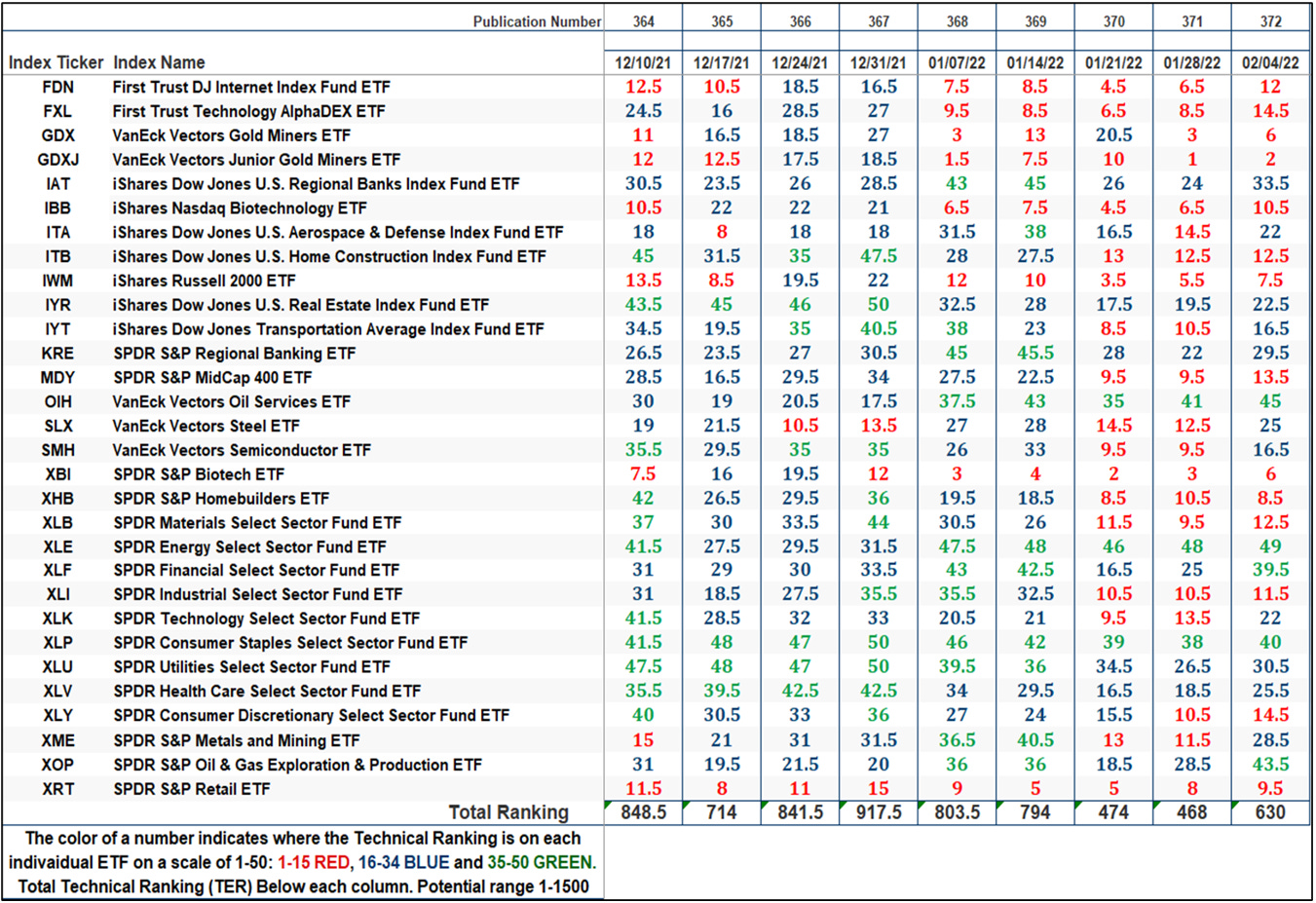

The SPX Index with This Week’s Complete ETF Rating “TER” Overlayed in Blue

The “TER” Indicator is a complete of all 30 ETF rankings and could be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator (chart beneath). As a affirmation/divergence software: If the broader market as measured by the SPX Index (SP) continues to rally with out a commensurate transfer or greater transfer within the “TER” the continued rally within the SPX Index turns into more and more in jeopardy. Conversely, if the SPX Index continues to print decrease lows and there’s little change or a constructing enchancment within the “TER” a optimistic divergence is registered. That is, in a trend, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the “TER” will get to the 1500 stage (all 30 ETFs having a “TR” of fifty) “issues can’t get significantly better technically” and a rising quantity particular person ETFs have turn into “stretched” the extra of an opportunity of a pullback within the SPX Index, On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential transferring common in Pink smooths the risky “TR” and analytically is a greater indicator of pattern.

Though the “TER” registered a 34.62% bounce to 630 from the earlier week’s 468 studying, the pattern stays decrease. Except the “TER” prints a better excessive above the December thirty first studying (917.5) the take away is that we will count on that the Friday, October 1st low of 4,388 within the SPX Index to be examined.

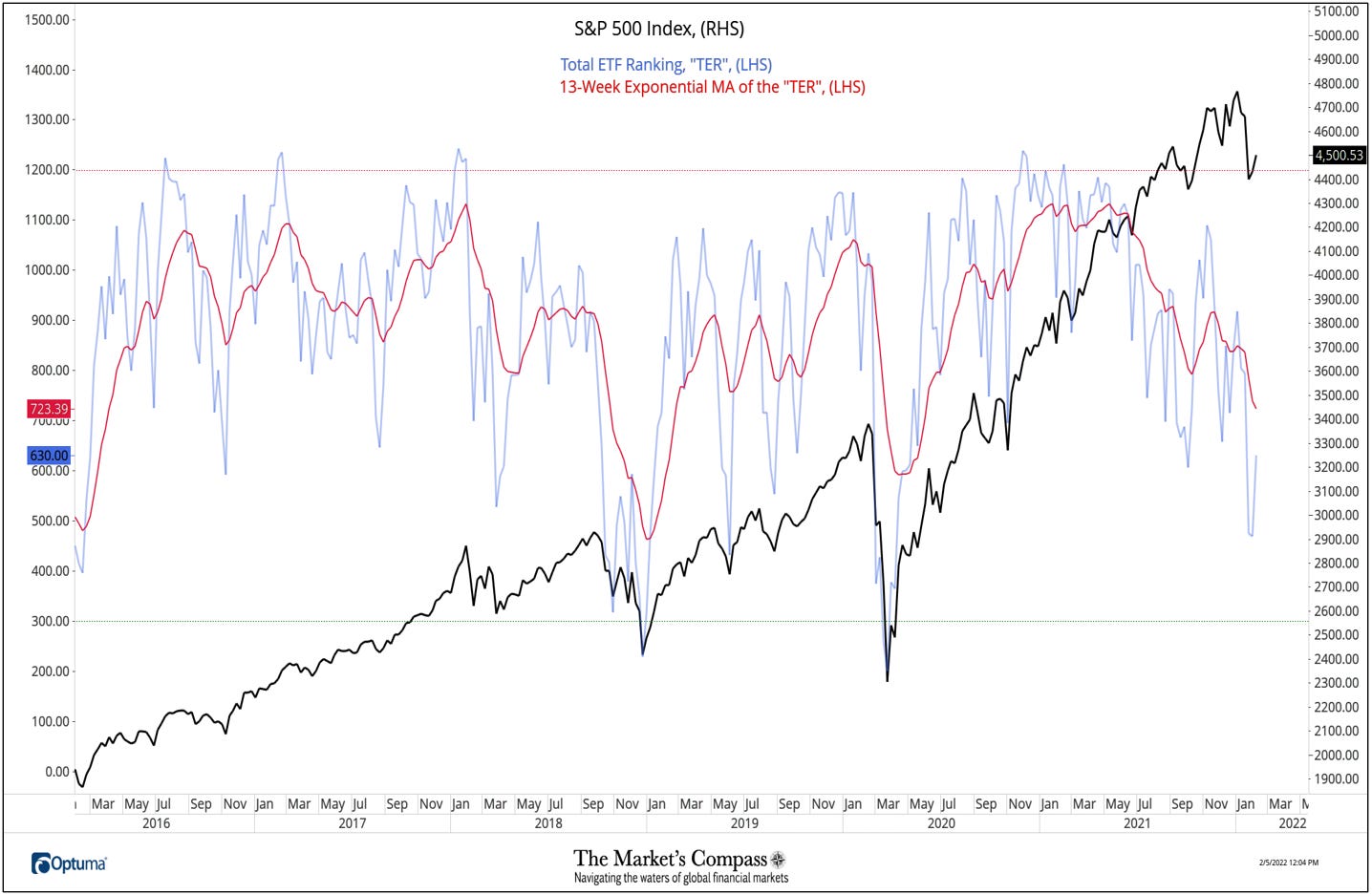

The Common “TR” Rating of the 30 ETFs

The Common Weekly Technical Rating (“ATR”) is the common technical rating of the 30 US Index and Sector ETFs we observe weekly and is plotted within the decrease panel on the Weekly Candle Chart of the SPX Index offered beneath. Just like the “TER”, it’s a affirmation/divergence or overbought/oversold indicator.

The “ATR” printed a divergence (decrease excessive as proven by the violet dashed line) in late December whereas the massive cap index went on to a brand new excessive. Additionally telling was when the brief time period transferring common of the “ATR” (purple line) “kissed” the long term transferring common and resumed its decline. Though the “ATR” is monitoring decrease it has not but reached an oversold excessive.

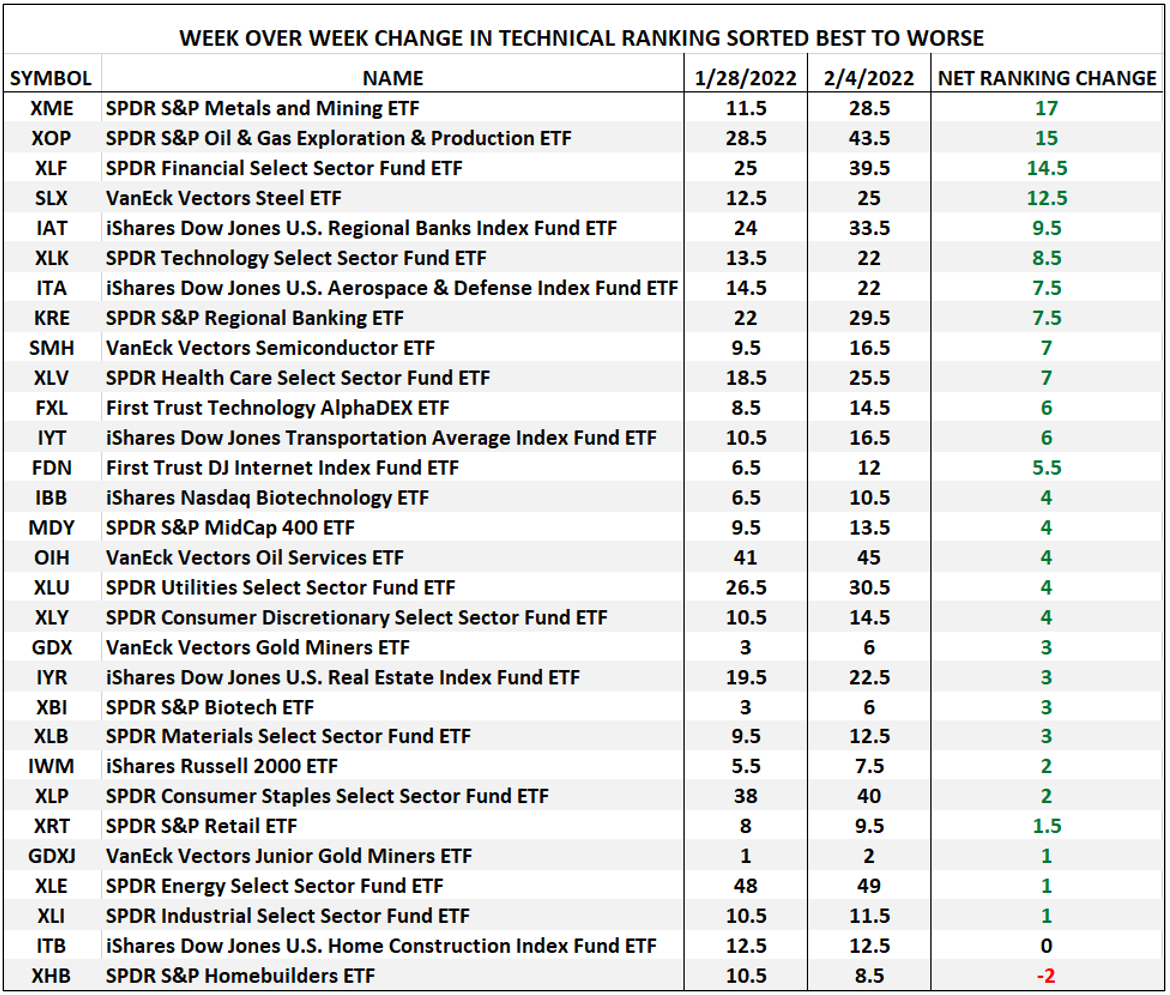

The Week Over Week Change in Technical Rankings

After two weekly readings beneath 15 the XME (SPDR S&P Metals and Mining ETF) “TR” bounced sharply, rising 17 to twenty-eight.5 from11.5. The second greatest week over week “TR” gainer was the XOP (SPDR Oil & Fuel Exploration and Manufacturing ETF) which jumped 15 to 43.5 from 28.5, rising again up into the higher quartile in live performance with a brand new two yr weekly closing excessive (chart beneath). Observe that MACD of the “TR” (decrease panel) has flip up via it’‘s sign line and the momentum oscillator of the “TR” is starting to trace again into optimistic territory.

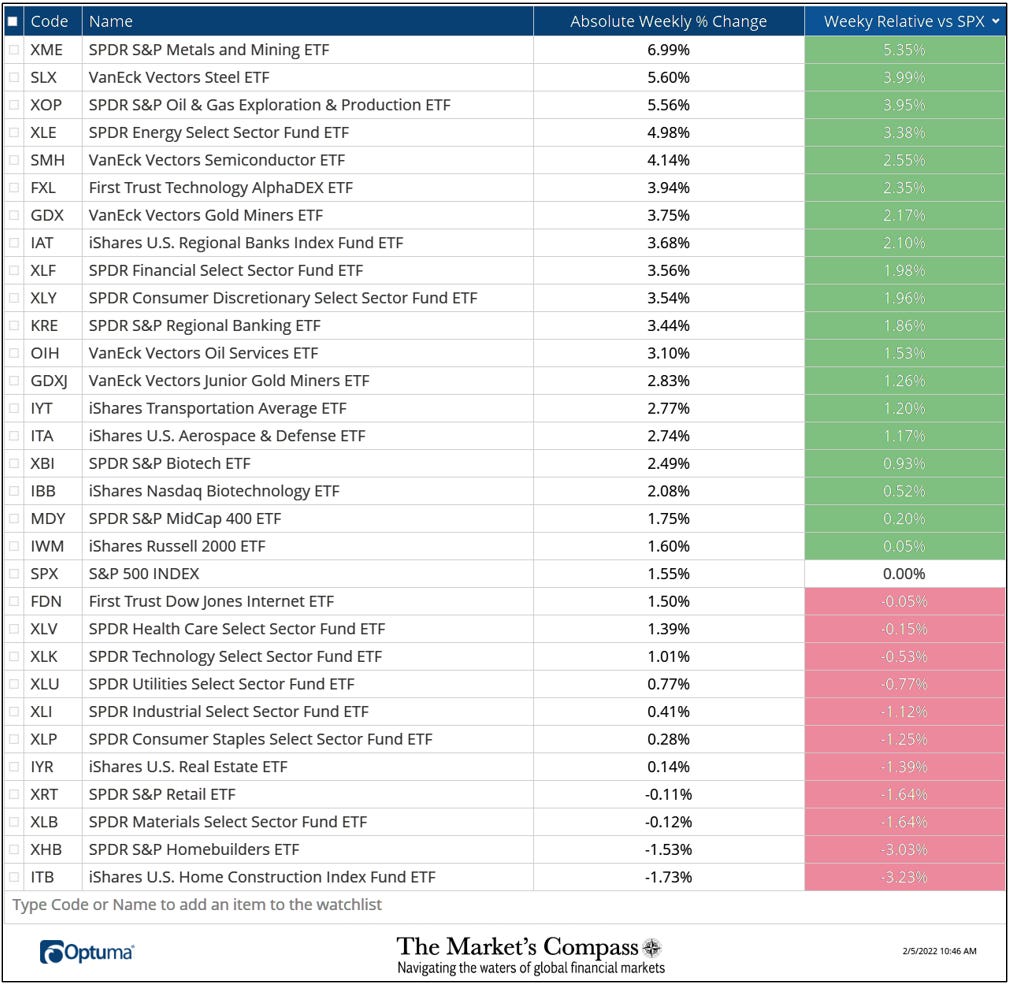

The Weekly Absolute and Relative Value % Change*

*Doesn’t together with dividends

The afformentioned XME and XOP ETFs have been two of the highest three greatest performing ETFs on an absolute foundation up +6 .99% and +5.56% final week. Sandwiched between the 2 was the SLX (VanEck Vectors Metal ETF) up +5.60%. The highest 15 holdings of these three ETFs are proven beneath. Knowledge is courtesy of Bloomberg.

XME Holdings

XOP Holdings

SLX Holdings

The Relative Return Vs. the SPX Index Yr to Date*

*Doesn’t together with dividends

I invite our readers to contact me with any questions or feedback at…tbrackett@themarkets compass.com

[ad_2]

Source link