[ad_1]

Share this text

The market is reacting negatively to the buyer worth index’s report on U.S. inflation.

Bitcoin, Ethereum Dip on Inflation Replace

U.S. inflation has hit a 40-year year-on-year excessive, and crypto property are sliding in response.

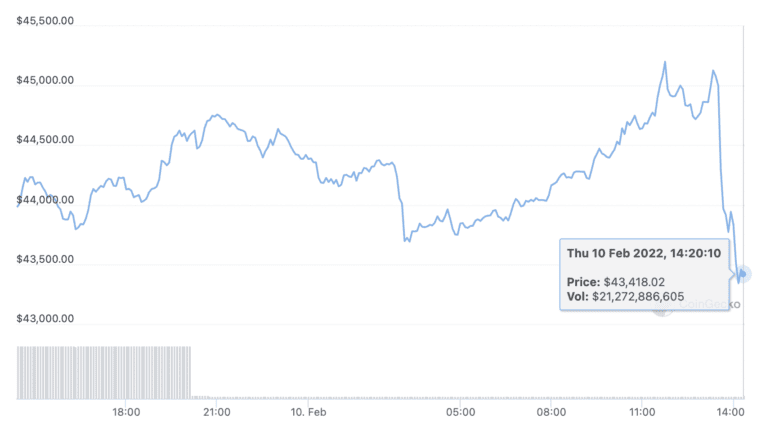

Bitcoin and Ethereum each dipped Thursday instantly after the Labor Division reported that the buyer worth index had jumped 7.5% since final 12 months. Value hikes in January contributed to the yearly rise as the price of all objects elevated by 0.6%.

The 7.5% determine is the very best U.S. inflation fee the CPI has recorded since 1982. The Dow Jones had estimated that the determine would are available at 7.2%. Markets shortly reacted because the information that the speed had surpassed predictions broke, with futures on the S&P 500 and Nasdaq-100 respectively falling 0.8% and 1.3%.

Bitcoin took a 3.5% dip from round $45,000 to $43,400, whereas Ethereum fell from round $3,250 to $3,100. Many different decrease cap property, together with the choice Layer 1 cash Solana, Avalanche, and Terra, had been more durable hit.

The droop throughout world markets marks a stark distinction to the response to the information that U.S. inflation had hit file ranges in November, when Bitcoin and Ethereum each rallied to all-time highs on the identical day. The distinction this time round is that the 7.5% soar signifies that the Federal Reserve is prone to push forward with vital rate of interest hikes in 2022 as deliberate (when rates of interest enhance, risk-on property are likely to tumble as the price of borrowing cash jumps).

The Fed first signaled that rate of interest hikes can be coming in December, and crypto property dipped on the information. Markets then dipped when Jerome Powell confirmed the speed will increase in January. The market has regarded shaky since, with each Bitcoin and Ethereum keep momentum. They’re respectively down 37.5% and 36.2% from their highs recorded in November.

With rate of interest hikes trying more and more possible this 12 months, crypto believers will likely be hoping that the market could make a restoration with out spilling an excessive amount of extra blood.

Disclosure: On the time of writing, the writer of this piece owned ETH and a number of other different cryptocurrencies.

Share this text

Bitcoin Hits $69,000 Alongside Rising U.S. Inflation Charges

Bitcoin continued its upward development right now, hitting one other all-time excessive amidst reviews of rising inflation in the US. Bitcoin Value $69,000 This Morning Early Wednesday morning, Bitcoin’s worth jumped…

What’s Rarible: A DAO for NFTs

What was as soon as dismissed as a foolish and costly sector, NFTs give creators entry to world markets in a means that’s by no means been potential earlier than, and it’s all because of blockchain.These acquainted…

Bitcoin Falls 5% as Fed Confirms Curiosity Charge Hikes

Bitcoin costs fell by roughly 5% right now alongside information that the U.S. Federal Reserve will increase rates of interest within the coming months. Bitcoin and Ethereum Are Down Bitcoin (BTC) costs…

Markets Droop in Wake of Fed Assembly

The Fed will stick with its plan of elevating rates of interest in March, based on the report from this week’s Federal Open Market Committee assembly, launched right now. Though the transfer…

[ad_2]

Source link