[ad_1]

UniSwap Professionals

- Consumer-friendly design

- Full transparency and open supply code

- Excessive curiosity for liquidity provision

- No KYC course of

- No registration

- All ERC20 tokens supported

UniSwap Cons

- Would not settle for fiat forex

- Threat of impermanent loss

- Solely helps belongings on the Ethereum blockchain

- Excessive transaction and gasoline charges

Uniswap is an progressive decentralized trade protocol that goals to resolve decentralized exchanges’ liquidity drawback by permitting the trade platform to swap tokens with out counting on consumers and sellers creating that liquidity. Uniswap trade incentivizes its customers to keep up the trade’s liquidity, offering parts of the transaction charges and newly minted UNI tokens to those that take part.

UNI is the token for Uniswap. It’s a governance token, so homeowners can take part in selections on community upgrades and insurance policies, with every vote being proportional to the quantity of UNI cryptocurrency they stake.

Learn on for our UniSwap overview to be taught the whole lot it is advisable to know in regards to the Uniswap mission, its professionals and cons, the UNI token, and the best way to begin making swaps on Uni.

Let’s dive proper into it!

Decentralized Change

Decentralized exchanges, alternatively often called DEXs, are peer-to-peer marketplaces the place crypto merchants transact with no custodian or middleman to authorize and oversee trades. DEXs function a substitute for centralized exchanges. They use liquidity swimming pools as a substitute of full-fledged order books and let customers commerce in a protected and personal atmosphere. The transactions on DEXs are facilitated by means of a wise contract, a self-executing settlement written in code.

Centralized exchanges provide companies much like these offered by a financial institution. The financial institution safeguards its shoppers’ funds and contains surveillance and safety companies. In distinction, decentralized exchanges, like UniSwap, provide autonomous on-chain transactions at marginal prices by leveraging sensible contracts.

Merchants have to protect their funds and take accountability for shedding them in the event that they make errors comparable to dispatching funds to the unsuitable deal with or shedding their non-public keys. Deposited belongings or funds of shoppers are issued an IOU (I personal you) through decentralized trade portals. An IOU is a blockchain-based token with the identical worth because the underlying asset, and anybody can commerce an IOU on the community.

The Ethereum blockchain is host to the most well-liked decentralized exchanges.

UniSwap App Evaluate

Overview

UniSwap is an automatic liquidity protocol and some of the common decentralized exchanges within the crypto market. As an Ethereum based mostly protocol, the UniSwap trade creates liquidity between ERC 20 tokens by using an autonomous liquidity system, a comparatively new buying and selling mechanism that eliminates the necessity for licensed intermediaries whereas prioritizing scalability and safety.

UniSwap affords a wholly self-regulated, decentralized atmosphere the place customers preserve complete management over their funds, not like a centralized trade which makes customers surrender their non-public keys. As such, no single enterprise can personal, handle, or govern its platform.

UniSwap turned the primary broadly used permissionless DEX to let customers commerce any Ethereum based mostly token instantly, with none withdrawal or deposit to a Centralized order e book. Uniswap removes the idea of order books in favor of an automatic market maker to offer the absolute best market price utilizing a particular, deterministic algorithm. Customers merely choose an enter and output token quite than specifying what value to purchase or promote crypto, whereas Uniswap offers the absolute best market price.

UniSwap has developed into some of the common exchanges on the Ethereum blockchain for individuals to commerce crypto and swap belongings. The trade doesn’t maintain belongings and lacks an order e book; this makes UniSwap protected in comparison with conventional exchanges.

Anybody can use the UniSwap protocol to commerce ERC-20 tokens and earn buying and selling charges by offering liquidity to the protocol.

UniSwap Evaluate (Background)

Hayden Adams, a younger but proficient designer/developer, is the founding father of UniSwap. Hayden and a small staff of lower than 10 constructed the DEX with a $100k grant from the Ethereum Basis.

In April of 2019, UniSwap closed a $1M seed spherical lead by paradigm and went on to launch UniSwap V2 in Could 2020.

UniSwap has since raised an $11M Sequence A spherical, launching its native token UNI and solidifying its place as the highest DEX on Ethereum.

UniSwap Variations

UniSwap has launched successive variations with up to date protocols whereas its consumer base will increase.

UniSwap v1

On Nov 2, 2018, UniSwap model 1 was launched on the Ethereum mainnet. UniSwap V1 supported solely the swapping of ETH-ERC 20 pairs. If customers wished to swap USDC for DAI, they first needed to swap USDC for ETH, then ETH-DAI to get DAI.

UniSwap V1 additionally facilitated the idea of LP tokens. When a liquidity supplier provides liquidity to any pool, they obtain liquidity supplier tokens, Representing the added liquidity. These LP tokens can then be burned or staked to redeem rewards. Buying and selling charges are incurred to reward LPs.

UniSwap V2

The Proof-of-Idea of the UniSwap V1 was a terrific hit that boosted the community to launch the up to date UniSwap V2 in Could 2020.

UniSwap V1’s main disadvantage was the “ETH bridging” drawback, i.e., the absence of ERC20-ERC20 token swimming pools, which resulted in excessive spillage and escalated prices when a consumer needed to swap one ERC20 token.

Uniswap V2 was an improve in consumer interface and expertise. Additionally, it eradicated the ETH bridging drawback by letting within the idea of ERC20-ERC20 swimming pools. The utilization of wrapped ETH as a substitute of native ETH within the core contracts, flash swaps, and a local value oracle are different important variations between UniSwap V2 and UniSwap V1. Nonetheless, by means of helper contracts, merchants can use ETH.

UniSwap V2 Flash Swap

UniSwap flash swap idea permits customers to withdraw any quantity of ERC20 tokens with out an upfront fee. Nonetheless, they might both pay for the tokens withdrawn or pay for a portion and return the remainder or return all of the withdrawn tokens on the finish of the transaction execution.

UniSwap additionally launched a protocol charge, and group governance performs a basic function in turning this charge on or off. 0.05% of the 0.3% buying and selling charge is taken because the protocol charge and is reserved for the UniSwap platform improvement that shapes the roadmap of the community.

UniSwap V3

UniSwap launched its newest model UniSwap V3 in Could 2021 on the L1 Ethereum mainnet. The unique announcement in March 2021 mentioned that an L1 optimism deployment was anticipated to comply with shortly afterward.

Not like V1 and V2, UniSwap V3 offers a versatile charge construction with higher accuracy and capital effectivity. In comparison with V2, liquidity suppliers get excessive returns on their capital to offer liquidity with 400x capital effectivity.

UniSwap V3 goals to surpass centralized exchanges and stablecoin-based automated market makers by facilitating low-slippage commerce execution.

Options of UniSwap V3

Concentrated Liquidity: The form of the AMM may be estimated by liquidity suppliers, as they’ll construct distinctive value curves based mostly on their preferences. LP’s capital may be centralized inside customized value ranges, enhancing their liquidity at desired costs. Concentrated liquidity is meant to decrease the quantity of capital the dealer should commit. This function ensures the upper capital effectivity of the asset pool. The V3 pool contract doesn’t assist normal ERC20 tokens; it as a substitute requires that the contracts are backed by further logic for reinvesting and distributing the charges collected.

Lively liquidity: Liquidity is mechanically taken out of the pool and can not earn rewards when the market experiences value modifications past the LP’s specified value vary. Whereas ready for the market to drive on the specified value vary, the liquidity is shifted to much less worthwhile belongings; this ensures the wellbeing of LPs within the UniSwap buying and selling ecosystem. To start out incomes rewards once more, LPs can replace their value vary to satisfy the present market value vary.

Payment Flexibility

UniSwap V1 flat charge was 0.3%. Your complete value was allotted for LP rewards.

UniSwap V2 has a complete charge of 0.005%, reserved for the community’s improvement.

UniSwap V3 arrives at authorities ruled flexibility by means of three numerous charge tiers:

- 0.05% for stablecoins like DAI/USDC

- 0.3% is incurred by normal non-correlated swimming pools like ETH/DAI

- 1.00% for non-correlated pairs.

Turned off by default, one can activate the protocol charge for specific swimming pools by means of governance, and the fee may be set between 10%-25% of LP charges.

Liquidity Swimming pools

UniSwap is an automatic liquidity protocol. Automated Market Marker (AMM) refers to sensible contracts that present liquidity swimming pools/reserves that merchants can commerce in opposition to. Liquidity suppliers can create liquidity swimming pools by depositing tokens into an Ethereum based mostly sensible contract. The pool might comprise stablecoins comparable to USDT, DAI amongst others. The merchants who make the most of the AMM are charged a charge which is distributed throughout the liquidity suppliers based on the proportion they’ve staked within the pool.

The UniSwap ecosystem depends on two varieties of sensible contracts, particularly an trade and manufacturing facility contract. The trade contract’s objective is to carry a pool consisting of particular tokens. The manufacturing facility contract is how customers create new trade contracts. These swimming pools comprise pairs of tradable currencies; for instance, an investor may put ETH and UNI right into a liquidity pool on UniSwap; they’d then get a proportion of the buying and selling charges every time ETH is swapped for UNI or UNI for ETH.

UniSwap’s liquidity swimming pools have little to no value influence for the overwhelming majority of transactions resulting from underlying mechanisms.UniSwap makes use of the fixed product market maker mannequin that allows the trade at all times to offer liquidity, regardless of the dimensions of the liquidity pool. For this market maker mannequin to work, the spot value of any given asset will increase as the specified amount will increase. Though giant orders might undergo from elevated value influence, operating out of liquidity isn’t a fear for the system. This implies UniSwap at all times maintains an combination provide of sensible contracts; that means, the bigger the pool will get, the decrease the slippage throughout any buying and selling pair is prone to be.

To assist mitigate, Uniswap permits one to specify a most value when inserting an order.

Liquidity Suppliers

UniSwap can provide crypto buying and selling due to its liquidity suppliers or LPs. By offering liquidity, LPs earn crypto as a result of they obtain a minimize of the trade’s transaction charges. By submitting collateral for either side of the market, LPs can present capital to any liquidity pool; because of this you have to provide an equal quantity of DAI and USDC should you’re seeking to present capital to the DAI/USDC market to keep up the Fixed Product automated market maker.

UniSwap grants customers liquidity tokens, which report how a lot of any given liquidity pool you’re chargeable for when liquidity is provided. Liquidity suppliers can redeem their tokens at any time for the underlying collateral.

UniSwap costs a 0.3% charge on every transaction, cut up amongst all of the liquidity suppliers to incentivize them; these charges are instantly added again to the market on the switch time, leading to deeper spreads throughout the board. Professional-rata stakes grant liquidity suppliers possession over a bigger pool of capital. To place it merely, the extra transactions available on the market, the extra charges collected and the extra revenue a market maker earns.

Transaction Charges

UniSwap costs a charge on every commerce. It was once 0.3% earlier than UniSwap V3 launched charge tiers based mostly on the liquidity pool volatility:

- Very Steady pairs – 0.01%

- Steady pairs – 0.05%

- Most pairs – 0.30%

- Unique pairs – 1.00%.

The flat charge of 0.3% for each commerce is barely above the worldwide trade common of round 0.25%. But, one can’t deny that the trade has an honest providing.

The trade can get fairly busy, and low gasoline makes failed transactions frequent. Trades may also fail, even when there may be sufficient ETH steadiness to cowl the gasoline charges transaction. Though your Ethereum is reverted to you in case your transaction fails, as soon as the gasoline charges are deducted, they don’t seem to be refunded.

UniSwap withdrawal charges are aggressive in comparison with different exchanges, which cost low buying and selling charges however hit you with excessive withdrawal charges in your means out. The trade solely costs community charges when a transaction has been executed.

How you can Use UniSwap

You should use UniSwap to promote or purchase crypto and earn curiosity. To make use of UniSwap, you first have to attach your crypto pockets to it and proceed to:

Select the swap choice, then choose the crypto you need to commerce and the crypto you want to obtain.

With the pool choice, you possibly can open a brand new place and deposit any two cryptos you need to commerce within the UniSwap pool, like ETH/USDT. In the event you’re uncertain what to stake, you possibly can try the highest swimming pools for choices.

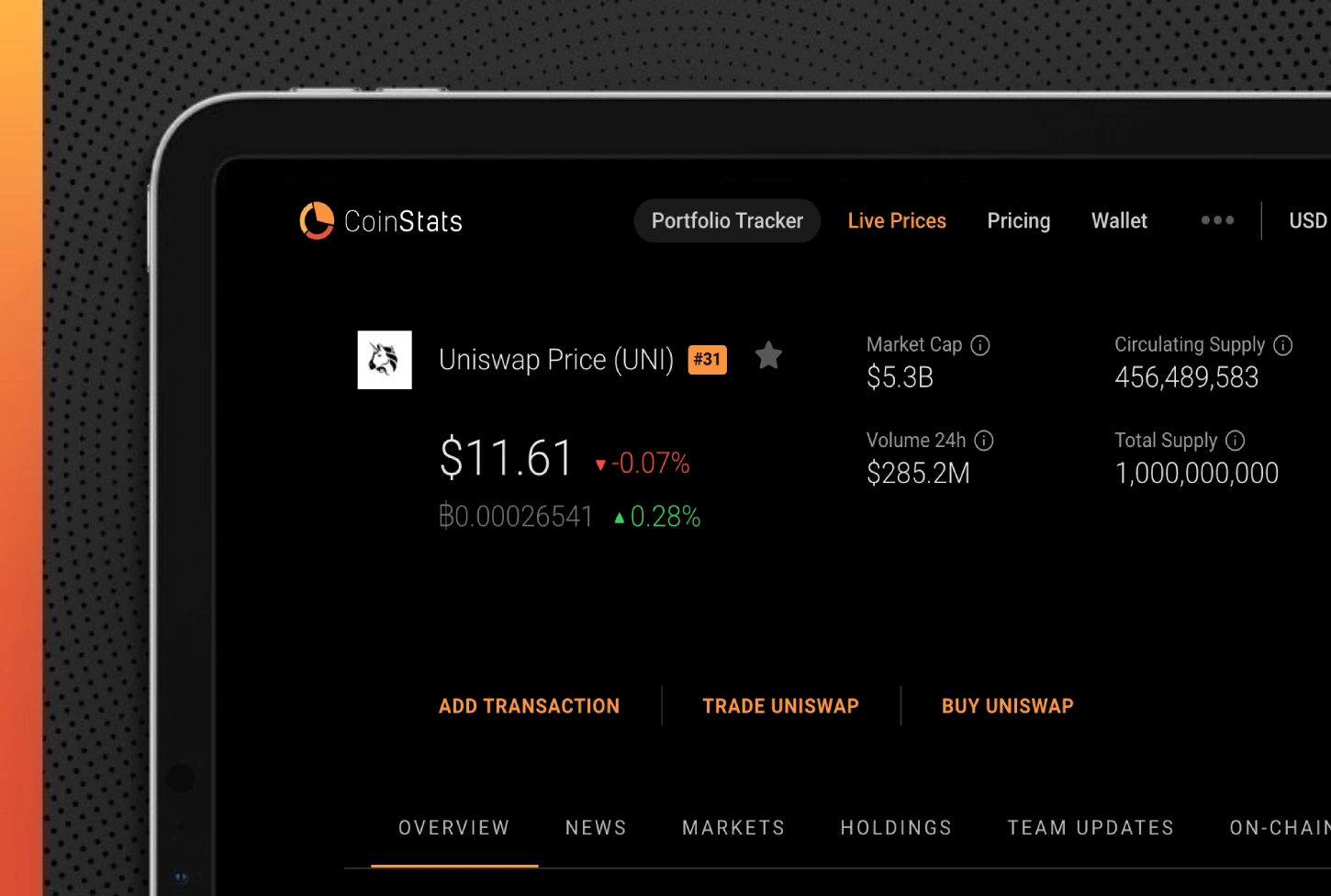

A platform like CoinStats offers you entry to the UniSwap trade and different decentralized finance apps for quick and environment friendly administration of your crypto belongings.

A number of free crypto wallets, comparable to Belief pockets, Coinbase pockets, and Metamask pockets are common choices. The CoinStats Pockets can be a wonderful resolution for storing your cryptocurrency.

After you have your pockets, generate an deal with and ship your crypto to it. You possibly can then start buying and selling or staking on the trade.

Dangers

Probably the most appreciable danger with buying and selling on UniSwap is shopping for rip-off tokens or falling for rip-off tasks like rug pulls. A rip-off token is a token masquerading as belonging to a reputable mission. At all times verify and confirm the token contract deal with earlier than you begin crypto buying and selling.

Ultimate Ideas

In a world the place obstacles and hurdles proceed to restrict crypto adoption, UniSwap has succeeded in offering a DEX expertise that merchants have lengthy been trying to find.

UniSwap is a wonderful selection should you’re eager about leveraging your crypto stakings to develop your holdings. Nonetheless, as an investor, it’s clever to think about the cryptocurrency market’s excessive volatility and whether or not you’re snug with the dangers concerned.

[ad_2]

Source link